Defending the Weekend Portfolio Even More

Tagged:Investing

/

Politics

/

Retirement

/

Statistics

Trump continues to antagonize the world at large, and weaken America’s fiscal posture with destructive tax cuts. Some international leaders are threatening a sell-off in US Treasury bonds. Here’s our (small) defensive reaction in the Weekend Portfolio.

If the World Sells US Treasuries…

US Treasury bonds, and their inflation-protected cousins, TIPS, were widely regarded as the safest investments in the world. However, the US is behaving so badly, many foreign holders of our debt have begun thinking what was previously unthinkable: selling off their stocks of Treasuries. Mostly that’s been just talk in the past. After all, taking down the US debt market would likely cause a world-wide Depression that nobody wants. But the US now such a menace to itself and others, that seems like the reasonable move!

Two recent articles show some ominous cracks in the dam.

A small-ish Danish pension fund, AkademikerPension, says it’s going to dump \$100 million

in US bonds by February, i.e., now. [1] Now, true, that’s

not much compared to the size of the debt market. But considering how conservative

European pension funds are, and how unthinkable this would have been just a year ago, it’s

a very significant early warning.

A small-ish Danish pension fund, AkademikerPension, says it’s going to dump \$100 million

in US bonds by February, i.e., now. [1] Now, true, that’s

not much compared to the size of the debt market. But considering how conservative

European pension funds are, and how unthinkable this would have been just a year ago, it’s

a very significant early warning.

Not at all coincidentally, the Swedish pension fund Alecta says it has already sold of

almost all of its Treasuries, amounting to \$7.7 – \$8.8 billion. [2] Again, that’s not a huge amount, but the first

signs of huge moves are always small.

Not at all coincidentally, the Swedish pension fund Alecta says it has already sold of

almost all of its Treasuries, amounting to \$7.7 – \$8.8 billion. [2] Again, that’s not a huge amount, but the first

signs of huge moves are always small.

Yes, this is an early reaction from a couple of pension funds which, after all, are rather small. But that’s how an avalanche starts: first just a small bit, then all at once. So we want to have in place measures which are (a) defensive against a decline in US Treasuries & TIPS, and (b) not too destructive to overall return.

How Can We Defend Against That?

Not defending Trump, of course: he deserves all he can get in terms of world leaders metaphorically slapping him around. Rather, how can we defend our portfolio which relies heavily on US Treasuries & TIPS for its bond sector?

This is a bit like asking how individuals can defend their homes in case of nuclear war. A US debt collapse would be so disastrous that we can’t really do much at all. Still, perhaps we can do something to hold off the damage in case there’s a reaction against the US debt that is very bad in itself, but not a total collapse. As we’ve written previously on this Crummy Little Blog That Nobody Reads (CLBTNR) [3] [4] [5] [6] [7], our neutral policy portfolio would be a bog-standard set of index funds, spread all around the world, at a 60% stocks and 40% bonds ratio, using US Treasuries & TIPS as the bond portion.

In a series of steps, encouraged by public advice from Vanguard, we had moved to a 40/60 allocation:

- 40% stocks / 60% bonds

- 40% US / 60% international in stocks and REITS

But within the stock sector, we remained 60% capitalization-weighted total market index funds to 40% “tilts” to small-cap and small-cap value funds. Those tilts importantly both capture the Fama-French model premia, and tilt us away from US large-cap big-tech AI bets, which look like sheer lunacy to me.

Also, just because we’re a bit conservative, we remained 50% US Treasury & TIPS / 50% international bonds. The Vanguard International Bond Index fund (VTABX) is intriguing: it’s mostly government bonds of developed nations, and has a currency hedge back to the dollar to eliminate currency risk. So it looks pretty much like Treasuries, just someone else’s Treasury backing it up.

It’s that last bit that we want to address now, before any hostility to Treasuries builds up.

In response to the world-wide, and generally well deserved, hostility to US Treasuries, we

decided to move the bond sector of our portfolio to 40% US Treasuries & TIPS / 60%

international dollar-hedged bonds.

In response to the world-wide, and generally well deserved, hostility to US Treasuries, we

decided to move the bond sector of our portfolio to 40% US Treasuries & TIPS / 60%

international dollar-hedged bonds.

-

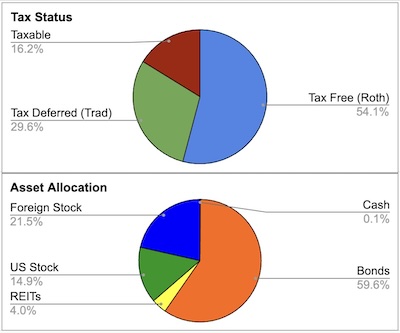

As you can see here in the first couple pie charts, our overall tax location and asset allocation haven’t changed much.

We’re still investing in the same broad asset classes in about the same way, with continuing effort to Roth convert funds to be more tax-free in the future.

-

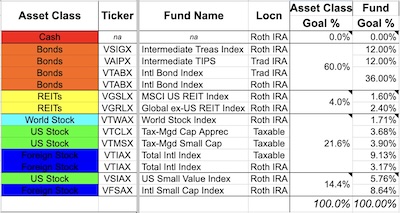

The changes come when you look at the bond portion of the allocation in the next table (the lines with the orange cells, labeled “Bonds”).

Here we’ve cut back to smaller allocations to intermediate Treasuries & TIPS, and expanded the foreign bonds.

-

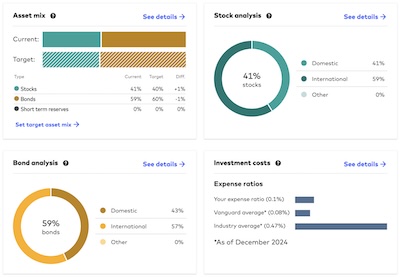

Just to be sure, I got another opinion by using Vanguard’s portfolio tools to get a snapshot of the resulting allocation. I might be wrong about the future, but I don’t want to blunder in how I prepare for it!

Vanguard’s tool confirms that we’ve done approximately what we intended, and that our expense ratio is a comfortingly low 10bp.

So now our portfolio is even more armor-plated against world hostility to Treasuries. We’re probably sacrificing some return. That’s acceptable, a bit like paying an insurance premium to off-load a risk. As Vanguard claimed in their advice, the 40/60 portfolio should have almost exactly the same return over the next 10 years as the 60/40 portfolio, but with dramatically less risk.

We now stand at:

- 40% stocks / 60% bonds

- 40% US / 60% international in stocks, REITs, and now also in bonds

- 60% cap-weighted total market index funds / 40% tilts to small and small-value index funds, within the stock sector.

The Weekend Conclusion

Keep in mind, this is not investment advice. I’m (a) unaware of your particular situation, and (b) neither competent, licensed, nor inclined to give investment advice.

It’s just a description of what we’re doing to cope with retirement.

Caveat investor.

(Ceterum censeo, Trump incarcerandam esse.)

Notes & References

1: M Katz, “Danish Pension to Sell Off All US Bonds Over ‘Weak’ US Finances”, Chief Investment Officer web site, 2026-Jan-01. ↩

2: Reuters Staff, “Swedish pension fund Alecta cuts US Treasury holdings, citing policy uncertainty”, Reuters, 2026-Jan-21. ↩

3: Weekend Editor, “Stock Diversifiers: Treasury vs Corporate Bonds?”, Some Weekend Reading blog, 2021-Jun-07. ↩

4: Weekend Editor, “The Weekend Retirement Portfolio”, Some Weekend Reading blog, 2021-Jun-19. ↩

5: Weekend Editor, “A Weekend Retirement Portfolio for the Trump-Revenant Era”, Some Weekend Reading blog, 2025-Feb-10. ↩

6: Weekend Editor, “Some More Revisions to the Weekend Retirement Portfolio”, Some Weekend Reading blog, 2025-Jun-11. ↩

7: Weekend Editor, “An Even More Defensive Weekend Retirement Portfolio”, Some Weekend Reading blog, 2026-Jan-02. ↩

Gestae Commentaria

Comments for this post are closed pending repair of the comment system, but the Email/Twitter/Mastodon icons at page-top always work.