An Even More Defensive Weekend Retirement Portfolio

Tagged:Investing

/

Politics

/

Retirement

/

Statistics

The US stock market has become a crazy bet on AI and the regulators have been corrupted, so it’s time to make some defensive moves… again.

Vanguard’s New Portfolio Recommendation

This summer, Forbes landed an interview with Vanguard’s chief investment officer, Greg

Davis. [1] This is a measure of how seriously Vanguard takes

this information: one does not get an interview with such an important person

easily, so Vanguard must really want to get the news out. (Though, strangely, Forbes

spent a paragraph describing how Davis was dressed, as if that meant something. I will

never understand why reporters are just obsessed about The Narrative, trying to make

everything about the personalities of people with power.)

This summer, Forbes landed an interview with Vanguard’s chief investment officer, Greg

Davis. [1] This is a measure of how seriously Vanguard takes

this information: one does not get an interview with such an important person

easily, so Vanguard must really want to get the news out. (Though, strangely, Forbes

spent a paragraph describing how Davis was dressed, as if that meant something. I will

never understand why reporters are just obsessed about The Narrative, trying to make

everything about the personalities of people with power.)

They’re lowering the percentage of US stocks they recommend in portfolios for a pretty straightforward reason: stocks are expensive, as measured by P/E ratio or the even better Shiller CAPE (cyclically averaged P/E ratio, also adjusted for inflation).

-

The P/E ratio of a stock, or better yet and index, is the price to earnings ratio. Divide the price of a stock by the trailing 12 months of earnings (or your estimated earnings going forward, if you’re daring).

This tells you how much you’re paying to buy the earnings of the business. A high P/E ratio (say, 20-30) means the stock is expensive compared to its earnings. This might be because investors think there’s a lot of growth possible, and that future earnings will be even higher. But… still expensive.

-

The Shiller CAPE, or Cyclically Adjusted P/E ratio, attempts to account for inflation and for the business cycle.

It looks back 10 years, inflation-adjusting all the earnings and averaging them. The 10 year lookback means you’re asking about the performance of the stock over (usually) an entire business cycle.

With the 10 year lookback, CAPE is more data hungry than the simpler P/E ratio, which makes Wall St types impatient with it.

Davis says Vanguard’s models predict the next decade will average about 1/3 of the returns in the previous decade:

“Our investment strategy group’s projection is that U.S. equity market returns are going to be much more muted in the future,” Davis warns. “Over the past ten years, the S&P returned an average of 12.4% annually. We’re predicting the figure to drop to between 3.8% and 5.8% (midpoint of 4.8%) over the next decade.”

Is the high CAPE ratio a reasonable concern?

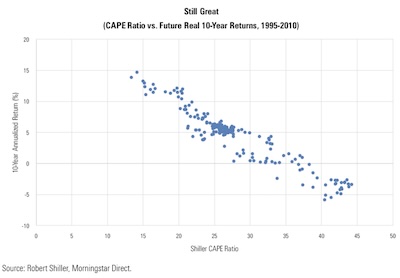

Finance professor Michael Finke did a study [2] which was picked up by John Rekenthaler at Morningstar a few years ago.[3] Rekenthaler, showing admirable skepticism, redid Finke’s regression using the inflation-adjusted CAPE and inflation-adjusted stock market returns data from Morningstar’s own databases.

As you can see from the plot, the fit is excellent. Finke reports an $R^2 \sim 90\%$ or better. That’s pretty astounding, given that it hasn’t really worked that well in previous periods.

As I write this, the US CAPE ratio (“Shiller PE”) stands at 40.30. Armed with that fact, look at the regression plot that predicts the next 10 years of inflation-adjusted stock returns being negative, and then tell me about your risk appetite for stocks!

Though, let’s be fair: if CAPE went from previously not working at predicting stocks to working now, nothing prevents it from going back to not working in the next decade. As Yogi Berra is alleged to have said, “Prediction is hard, especially when it’s about the future.”

So Davis says people who would normally have a 60/40 (60% stocks/40% bonds) portfolio should not only rebalance, but rebalance to 40/60, leaning hard into bonds. That’s… bold.

A couple weeks later, in August, Business Insider ran a similar article [4],

claiming Vanguard said:

A couple weeks later, in August, Business Insider ran a similar article [4],

claiming Vanguard said:

- Vanguard’s models forecast 3.3% - 5.3% annual stock returns, vs 4% - 5% for bonds over the next 10 years.

- People – like your humble Weekend Editor – who would normally prefer a 60/40 portfolio should move to a 30/70 portfolio.

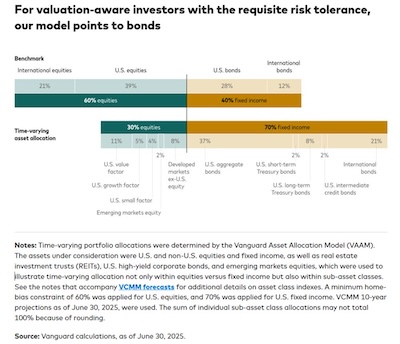

So they ran the mighty Vanguard Capital Markets Model (VCMM) to estimate future returns and their uncertainties, and they ran the equally mighty Vanguard Asset Allocation Model (VAAM) to construct recommended portfolios. The image here shows the results, tagged as having come from a run on 2025-Jun-30. It compares a 60/40 benchmark portfolio (top) with their proposed 30/70 portfolio (bottom).

Now… the Fortune interview where they recommended 40/60 was published 2025-Jul-24, and this Business Insider article recommending 30/70 was published 2025-Aug-06. So it’s just 2 weeks later, and they’ve gotten quickly more defensive? Why is the recommendation changing so rapidly, by such a large amount, and to an extremely defensive position? Do they know something the rest of us don’t?

It could be that the picture darkened dramatically in the 2 weeks between these publications. But it also could be that the VCMM and VAAM are just very sensitive to the input conditions, and don’t produce stable outcomes. In the latter case, it’s important not to be too fixated on the precise numbers, but rather to look at the general scenario: very high CAPE valuations, reasonable returns on bonds, and therefore low equity risk premia. In that situation, it makes sense to tilt more toward bonds, though it’s debatable exactly how much.

So we decided to check at the original source [5], because

getting information filtered through journalists obsessed with The Narrative is frustrating.

So we decided to check at the original source [5], because

getting information filtered through journalists obsessed with The Narrative is frustrating.

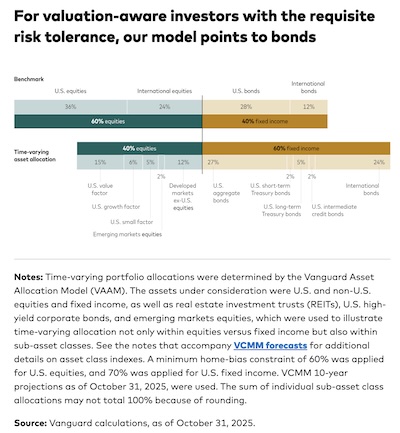

Here we see Vanguard’s updated portfolio, with data current as of 2025-Oct-31. (Compare the Business Insider reporting using a Vanguard model run of 2025-Jun-30.) They’ve gone back to a 40/60 recommendation, which is quite a bit less extreme than the scary 30/70 allocation.

Interestingly, there’s also some helpful information on suballocations, i.e., tilting the stocks toward value (away from high-P/E growth stocks), and small cap (away from the Magnificent 7 big tech stocks). I found that gratifying, because for many years I’ve been using Vanguard’s US small-cap value index fund and international small-cap fund for that exact purpose. Now even Vanguard is cautioning people not to lean too heavily on US large-cap growth stocks.

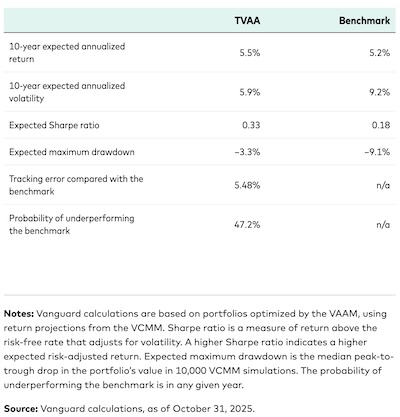

Also gratifying, for a quantitative old nerd like your humble Weekend Editor, is the inclusion of a table of portfolio characteristics. The table compares the 40/60 portfolio with the “benchmark” 60/40:

- On the second line, we see that the standard deviation of returns is about 1/3 less, which we would expect from a larger bond allocation.

- But on the first line, we see that the mean returns are within a few 10ths of a percent of each other (5.5% vs 5.2%) and slightly higher for the bond-heavy portfolio! So this is about earning roughly the same, just with far, far less volatility. I’m starting to like this plan!

- As risk measures, consider the 3rd & 4th lines:

-

The Sharpe ratio is the return beyond the risk-free rate, divided by the amount of risk:

\[S = \frac{E[R] - R_f}{\sigma[R]}\]That means it measures the amount of additional return you get for each unit of risk you take. Higher is better.

The 40/60 portfolio is at 0.33, while the 60/40 benchmark is at 0.18. So the 40/60 is a more efficient risk taker, getting more return for the risk it takes.

-

The max drawdown is how much the portfolio might go down, peak to trough. Closer to 0 is better. We see here the max drawdown is only about 1/3 of that for the 60/40 portfolio! Again, that’s to be expected with bonds, but it’s nice to see a projection of the protection.

-

-

Finally, on the last line of the table, is the thing I always want to see in any statistical model: what’s the probability this will work? Without that, I always wonder if somebody just forgot, or if they’re hiding it. Vanguard says there’s a 47% chance the 40/60 portfolio will underperform the 60/40. Ok, it would be nice to see that lower.

But, really: a null hypothesis would say that the portfolios are the same, and the probability of underperformance would be 50%. The fact that it’s 47% is very close to that, and says this is about volatility reduction, not return maximization!

So all of that looks pretty sensible to me.

One other thing to check, just to make sure we’ve nailed everything down tightly, is exactly what the VCMM projections of market returns were, and how they differ from other predictions by people who aren’t urging this much caution.

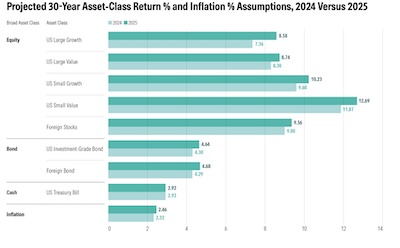

So we looked at Vanguard’s report on the VCMM run of 2025-Oct-31 [6] and what Morningstar’s financial analysts came up with [7] as a part of their recommendations on retirement withdrawal rates.

First consider Vanguard (click through on these charts to see them full-size):

First consider Vanguard (click through on these charts to see them full-size):

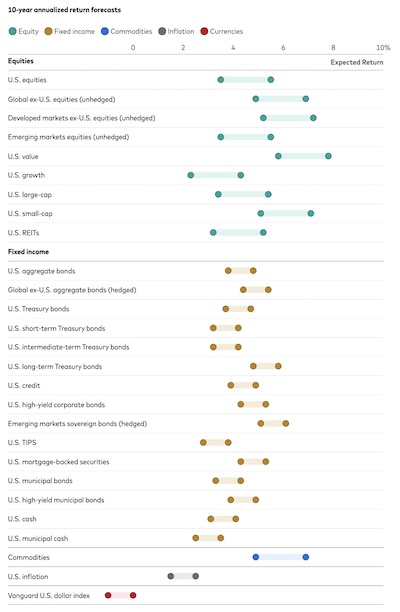

- Method: Vanguard’s forecast is a sophisticated Monte Carlo simulation, done by people whom I think are some of the best available. It’s estimating annualized returns over the next 10 years.

- Stocks: The stock market return forecasts are in the blue bars at the top of their

chart.

- Note that most of them are in the range of 3% - 5%, no more.

- US Large Growth is the most miserable sector.

- Things are much brighter if you tilt toward value stocks, small stocks, and ex-US international stocks, which are not so over-priced. So tilting to small-cap and value stocks, and strongly tilting to outside the US makes perfect sense.

- Bonds: The bond market return forecasts are in the yellow bars at the bottom of

their chart.

- First, note that these bond returns are in every way comparable to the stock returns! If you could get returns comparable to stocks while not having to take stock-like risk, wouldn’t you accept that bargain?

-

Second, Vanguard tends to like total bond market funds, including corporates. Here at Château Weekend, we tend to like US Treasuries, TIPS, and foreign government bonds (with a currency hedge back to the dollar).

As we’ve previously written here on this Crummy Little Blog That Nobody Reads (CLBTNR) [8], corporate bonds look like a Treasury bond with a small amount of stock market risk added. If you’re trying to diversify away from some stock risk, you can’t do that by adding more stock. Hence our choice of bonds will be a bit more restrictive than Vanguard’s (q.v.).

- Method: Morningstar is making a 30 year forecast, since they’re doing it for projecting retirement spending levels. They don’t quite say what they did, except to say it’s got a “top-down” portion from things like valuations and earnings growth rates and a “bottom-up” phase involving human input from their equity analysts. They’re a bit more traditional in that regard than Vanguard, for better or worse. (Mostly worse, I think, given that equity analysts can be crowd followers as much as anybody else. But it’s a point of comparison to Vanguard.)

- Stocks: Note that their forecasts for stock returns (30 years, vs Vanguard’s 10 years) are seriously higher, at 8% - 12%. That’s more of a “business as usual” forecast, not one that is aware of the high CAPE and the rampant political instability & corruption. Maybe they think in 30 years none of that will matter?

- Bonds: Morningstar’s bond predictions look to be pretty much in line with Vanguard’s.

-

Safe withdrawal rates vs equity percent: You might think that if Morningstar analysts predict stocks would have such high returns, they’d recommend more stocks in their retirement portfolios, right?

Not so: they figure out the withdrawal rates a portfolio will support, with 90% probability of not running out of money, as a function of stock percent. For a 30 year period, this maxes out for portfolios between 30% stock and 50% stock!

It’s somewhat surprising that this result is so low, given their rather sunny forecast. But it’s just realistic: if you must sustain withdrawals for decades, then the volatility of a high stock portfolio tends to kill you. Or at least bar you from getting their 90% success rates.

So while Morningstar forecasts much higher stock returns than Vanguard, they both come out with similar portfolio recommendations for sustainability looking forward 10 years or 30 years.

Again, this makes perfect sense to me.

What We Did

As we’ve written previously on this CLBTNR about the Weekend Portfolio [9] [10] [11], our neutral policy portfolio would be the good ol’ 60/40 stock/bond allocation. However, high valuations and catastrophic political destruction had forced us to get more conservative at a 50/50 stock/bond allocation. We even increased our ex-US stock and bond holdings.

Now, Vanguard and – in a different way – Morningstar have pushed me to think that this might not have been enough.

The question is, how much? We saw above that Vanguard’s allocation recommendations swung

from 30/70 to 40/60 over just a couple weeks. So the important thing is to take the

general advice that bonds have better prospects, and allocate a portfolio we can live

with. I settled on 40% stocks, 60% bonds.

The question is, how much? We saw above that Vanguard’s allocation recommendations swung

from 30/70 to 40/60 over just a couple weeks. So the important thing is to take the

general advice that bonds have better prospects, and allocate a portfolio we can live

with. I settled on 40% stocks, 60% bonds.

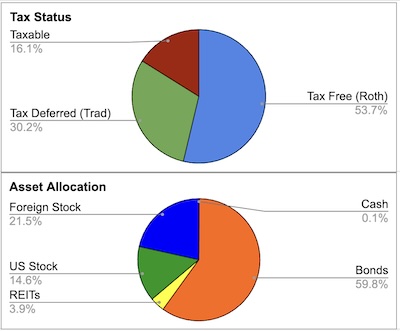

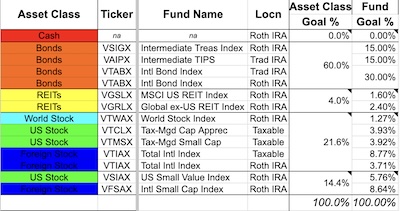

- Tax location: As you can see, the tax-free (Roth IRA) component has increased a bit. That’s because all the stuff likely to grow faster is in the Roth, with only bonds in the Trad IRA. Also, we’re continuing our campaign of doing annual partial Roth conversions, to get as much money put in the tax-free part of the portfolio before RMDs begin. That is, we’re diversifying the tax structure of the portfolio at the same time as the rest of this.

- Overall allocation: 40% stocks/60% bonds.

- US/International stock allocation: 40% US/60% international. This applies both to stocks in general and to REITs. It amounts to a moderate bias away from the US.

- US/International bond allocation: 50% US, equally between intermediate Treasuries and TIPS, and 50% international. The international bonds are mostly government bonds of developed nations, with a currency hedge back to the dollar, as Vanguard recommends.

- Tilts: We tilt fairly heavily away from US large-cap growth stocks, in favor of US small-cap value stocks, international small stocks, and REITs both US and international (another form of value stock, really).

I think that covers the bases:

- adjust the stock/bond ratio to be more in favor of bonds,

- tilt to small, value, and international stocks,

- keep the US bonds in intermediate term Treasuries and TIPS,

- have a large portion of international developed nation government bonds,

- continue to do partial Roth conversions to get a little more tax armor.

The Weekend Conclusion

Vanguard’s market forecasts are pretty dim, and bonds are offering pretty good competition with reasonable returns and less risk. The US CAPE ratio is currently quite high, at 40.30. Those 2 facts combine to lower the equity risk premium and lower the expectation of stock returns.

Tanking up on bonds just makes sense, particularly for a retiree who is in the capital preservation phase of life.

Look, I’m not saying it’s time to run for the hills and lay in a supply of food and water. And this extremely conservative (for me) portfolio is not the way I’d invest in normal times. But these are decidedly not normal times.

(Ceterum censeo, Trump incarcerandam esse.)

Notes & References

1: S Tully, “The investment chief at $10 trillion giant Vanguard says it’s time to pivot away from U.S. stocks”, Fortune, 2025-Jul-24.

NB: The link here goes to an archival site, to avoid the regrettable paywall. ↩

2: M Finke, “The Remarkable Accuracy of CAPE as a Predictor of Returns”, Advisor Perspectives, 2020-Jul-20. ↩

3: J Rekenthaler, “Maybe There’s Something to the Shiller CAPE Ratio, After All”, Morningstar, 2020-Jul-27. ↩

4: W Edwards, “Stocks are roaring higher this year, but Vanguard says investors should stick 70% of their money into bonds”, Business Insider, 2025-Aug-06. ↩

5: Vanguard Staff, “Bonds remain in favor in time-varying model portfolio”, Vanguard web site, 2025-Dec-10. NB: This article is apparently updated periodically, so you should expect to have to look at the latest version. ↩

6: Vanguard Staff, “Vanguard Capital Markets Model® forecasts”, Vanguard web site, 2025-Dec-10. ↩

7: AC Arnott, C Benz, & J Kephart, “What’s a Safe Retirement Withdrawal Rate for 2026?”, Morningstar, 2025-Dec-03. ↩

8: Weekend Editor, “Stock Diversifiers: Treasury vs Corporate Bonds?”, Some Weekend Reading blog, 2021-Jun-07. ↩

9: Weekend Editor, “The Weekend Retirement Portfolio”, Some Weekend Reading blog, 2021-Jun-19. ↩

10: Weekend Editor, “A Weekend Retirement Portfolio for the Trump-Revenant Era”, Some Weekend Reading blog, 2025-Feb-10. ↩

11: Weekend Editor, “Some More Revisions to the Weekend Retirement Portfolio”, Some Weekend Reading blog, 2025-Jun-11. ↩

Gestae Commentaria

Comments for this post are closed pending repair of the comment system, but the Email/Twitter/Mastodon icons at page-top always work.