On Inequality & Cornering Markets in Times Ancient & Modern

Tagged:ArtificialIntelligence

/

CorporateLifeAndItsDiscontents

/

Politics

/

Sadness

In the Gilded Age of the late 19th century in the US, the über-wealthy had a tendency to corner markets in commodities, to extract higher prices for themselves. Surely we’re not doing that any more are we? … Surely?

The Bad Old Days

Monopolies come in 2 kinds, broadly speaking: horizontal and vertical. (We’re glossing

over mountains of detail, but this is as good a place as any to start.)

Monopolies come in 2 kinds, broadly speaking: horizontal and vertical. (We’re glossing

over mountains of detail, but this is as good a place as any to start.)

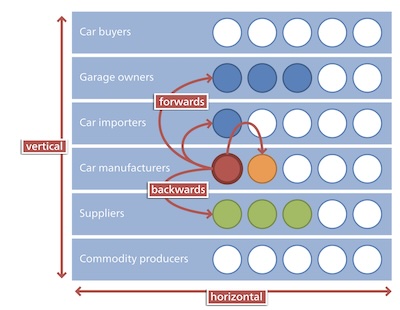

The Wikipedia explainers on vertical monopolies and horizontal monopolies are pretty good; the diagram at the right comes from those articles. It depicts, as an example, the phases of automobile manufacturing, distribution, and usage vertically. Horizontally are different companies that engage in each of those phases.

A vertical monopoly is a company that attempts to control a column, while a horizontal monopoly attempts to control a row:

-

A vertical monopoly is where 1 company tries to be a controlling force in each of the rows, i.e., building itself along the entire column in the figure.

It manufactures, distributes, sells, services, and garages cars in this example. This gives them opportunity for lock-ins: their cars take only their gas, their garages accept only their cars, their mechanics work only on their cars, their manufacturing workers and engineers are encumbered by non-disclosures to work only on their products, etc.

Carnegie Steel would be an example from the 19th century: they owned iron mines, they owned coal mines, they owned coke ovens, they owned railroads, they owned steel plants, and so on. This led to a furious level of integration that let them control costs, but at the expense of extracting monopoly profits from the markets and driving out competition.

Standard Oil was another such example in the 19th century: petroleum extraction, transport, refinement, and wholesale distribution were all under their control.

-

A horizontal monopoly is when a corporation builds itself along a row in the figure, e.g., basically controlling all the production in one step of the manufacture of cars.

If you control all the railroads, then you can make the steel companies pay you exorbitant fees to transport their coal, iron ore, and steel.

There are numerous such examples in the US now, such as airlines, pharmaceuticals, meat packing, telecommunications, entertainment, and so on. Each of those is controlled by a very small number of companies, with cross-agreements among the competitors.

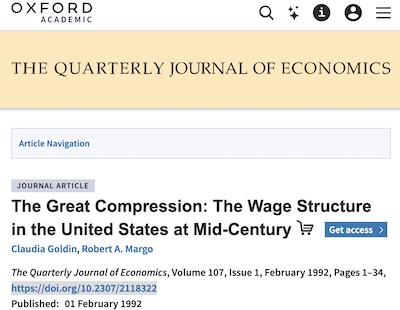

This caused all sorts of havoc in the late 19th century and the early 20th: periodic

economic panics and depressions, mind-boggling inequality, political corruption in the

service of the wealthy, and so on. It was fixed (mostly) over a period of decades, with

anti-monopoly laws like the

Sherman Antitrust Act of 1890,

progressive taxation in the 1930s, banking regulation, and so on. This lead to what economists

Claudia Goldin & Robert Margo called

the mid-20th century “Great Compression”

in a 1992 paper (riffing off the term “Great Depression”). [1]

This caused all sorts of havoc in the late 19th century and the early 20th: periodic

economic panics and depressions, mind-boggling inequality, political corruption in the

service of the wealthy, and so on. It was fixed (mostly) over a period of decades, with

anti-monopoly laws like the

Sherman Antitrust Act of 1890,

progressive taxation in the 1930s, banking regulation, and so on. This lead to what economists

Claudia Goldin & Robert Margo called

the mid-20th century “Great Compression”

in a 1992 paper (riffing off the term “Great Depression”). [1]

Inequality shrank dramatically, banking was stabilized with FDIC guarantees and the

Glass-Steagall acts of 1933

to control their risk taking, the Federal Reserve could moderate

economic downturns, and so on. This led to a period of stable growth.

The Bad Nowadays

Then we repealed all that, or let conservative Supreme Courts pick away at it until it was neutered, or at least declined to enforce it. (Similarly to the way we’ve allowed civil rights and voting rights to wither.)

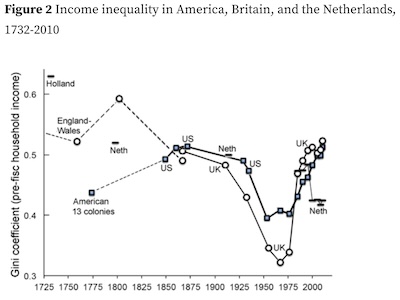

And now we’re back to the Gilded Age: by the

Gini coefficient, which measures

inequality, we’re in a second Gilded Age. We should expect monopolies, panics, economic

collapses, and political corruption. So… here we are:

-

According Williamson & Lindert, writing for the Centre for Economic Policy Research (CEPR) [2], American growth and inequality since 1700 show we are now at the inequality peaks of the first Gilded Age.

Here we reproduce their Figure 2, which has the goods. Note that the US was always a pretty unequal place, with an extraordinary interlude from 1940-1980. The post-WWII tax reforms and opened access to education (though sadly excluding most minorities and women), produced the “Great Compression” we cited via Goldin & Margo above.

Here it’s clear: beginning around Reagan, we began re-imposing the mechanisms of inequality with huge tax cuts for the wealthy, benefit cuts for the poor, and massive corporate welfare.

We are now, by the numbers, in a Second Gilded Age.

-

As former Labor Secretary Robert Reich, Obama economic advisor, Harvard/Brandeis/Berkeley professor has recently reminded us [3]: now the pay gap between workers and CEOs is 351-to-1 vs 21-to-1 in 1965.

One reason wages can’t go up is because all the increased profits from increased productivity have gone to the top.

(Reich proposes an additional corporate tax based on the CEO to (median?) worker ratio. While sensible, that, of course, will have to wait for the return of a degree of sanity to US politics.)

-

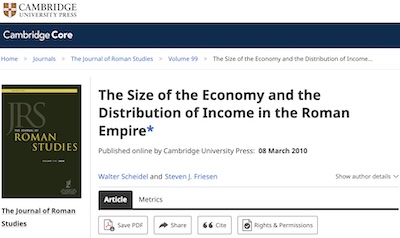

Not enough for you? How about the Roman Empire?

Scheidel & Friesen, writing in the Journal of Roman Studies in 2009 [4], go through all the elaborate details to estimate the Gini coefficient for various phases of the Roman empire. Their conclusion (bottom of p. 86): 0.42 - 0.44.

Note this very carefully: with the US at a Gini coefficient of around 0.5, we are now more unequal than the Roman empire, with its über-wealthy aristocrats vs its slaves.

We’ve also declined to enforce anti-monopoly laws in any meaningful sense. (And now, it appears that having a Trump associate involved, or paying a bribe to Trump, is a pre-requisite for getting mergers approved.)

|

|

|

|

|

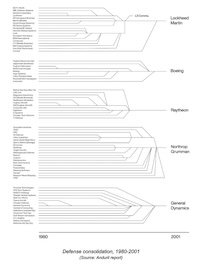

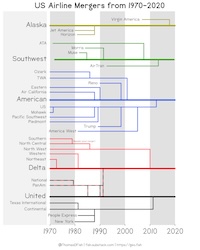

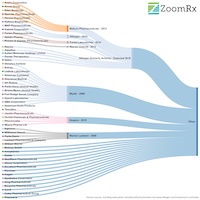

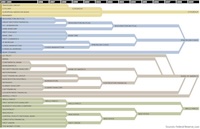

Here are some examples of how badly concentrated industries in the US have become in the last 40 or so years since Reagan. They show the tree of corporate mergers leading to just a few behemoths left today. (Click to embiggen any of these pictures.)

- Defense contractors (upper left) have collapsed from 75 companies to just 5.

- Airlines (upper right) have collapsed from 34 carriers to 5.

- Pharmaceuticals have done something similar. Here we show the corporate ancestries of

Pfizer (combining 52 companies into 1 giant), and Sanofi (combining 18 companies into 1 giant).

(Note that Sanofi is largely European; corporate mergers to form oligopolies is a phenomenon common in most of the developed world. Hence, so also is revenant fascism.) - Finally, at the bottom, we show how American banking became so concentrated: 37 banks became just 4 “too big to fail” banks that have their tendrils into everything. This is also why I’ve had 5 separate banks since coming to MIT as a grad student, despite never changing my account: the banks just kept eating each other!

These are huge concentrations of corporate power. With the ability of corporations to donate to political campaigns, particularly soft money and dark money, they are concentrations of political power as well.

It’s not just corporations that seek to monopolize things.

It’s not just corporations that seek to monopolize things.

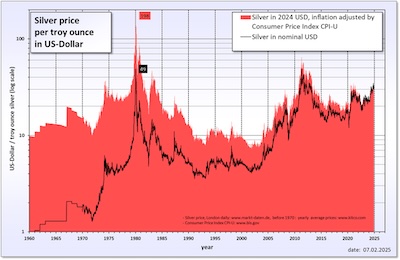

An example that stuck in my youthful memory was from 1980, when the Hunt brothers attempted to corner the world silver markets, leading to Silver Thursday on 1980-Mar-27 [5]. With the Iran hostage crisis in full flare, the prices of gold and silver climbed as investors worried about war. The billionaire Hunt brothers sought to control substantially all the silver on the world markets, with a series of leveraged commodity moves.

At one point in 1979, they apparently controlled over 100 million troy ounces of silver, about 1/3 of the world’s silver not held by governments.

This caused a collapse and commodity market panics, which had to be bailed out by a consortium of banks. (NB: They provided a bailout to the Hunt brothers, not to people who were damaged by their monopoly.) If that had not happened, a number of brokerages and banks might have collapsed, having lent money to the Hunt brothers for their boondoggle.

This is what happens when we allow too much concentration of wealth and power, with little meaningful restraint: they will attempt to achieve complete control, and will require massive bailouts when they fail.

This is what “privatize the profits, socialize the losses” means. It should have been obvious in 1980, but here we are, 46 years later, still avoiding the lesson.

… And Now, Today’s Outrage du Jour

So it should come as no surprise that our modern oligarchs pursue the same strategy.

While I’m familiar with “Moore’s Law is dead” as a (mildly questionable) saying, I haven’t read the blog of that name. But they’ve reported an important story on their blog and their YouTube channel that I haven’t seen much in the traditional media. [6]

Just as the Hunt brothers spiked the price of silver, the writers noticed a 156% jump in DRAM over a period of about 3 weeks. It’s enough that the DRAM alone would cost more than the whole computer did before the price jump. DRAM is, indeed, becoming almost unobtainable. Apparently several DRAM manufacturers have contacted wholesalers and retailers, to see if they could buy back inventory.

Their analysis:

So what happened? Well, it all comes down to three perfectly synergistic events:

- OpenAI executed two unprecedented RAM deals that took everyone by surprise.

- The secrecy and size of the deals triggered full-scale panic buying from everyone else.

- The market had almost zero safety stock left due to tariffs, worry about decreasing RAM prices over the summer, and stalled equipment transfers.

Apparently OpenAI signed deals with Samsung and SK Hynix – with near simultaneity – to acquire 40% of the world’s DRAM supply for themselves alone. They even managed to keep Samsung and SK Hynix from knowing about each other’s deals, to prevent them from going up in price.

Add to that the tariff chaos, and you have a situation where the DRAM manufacturers had no slack inventory at all.

And the weirdest part: they’re buying uncut, unfinished wafers. They’ll apparently be stockpiled, either to be finished into usable modules later, or just to cut supplies to competitors else now. Manufacturers are now quoting 13 month lead times on memory.

That makes it look like OpenAI isn’t just defending their own supply of memory, but attempting to choke the market to cut off anybody else. There are reports that OpenAI is attempting to buy up the DRAM manufacturing equipment as well, to deny future manufacturing capability.

This is a classic monopolist’s move!

The Weekend Conclusion

Look, billionaires are just no good. We should tax them down to, say, $100 million each, maybe?

We remind everyone of screenwriter John Rogers’s 3rd Rule of Crime:

Rule 3: Nothing ever stops until a Rich White Guy goes to jail.

That’s the moderate solution. The other solutions probably involve tumbrels.

(Ceterum censeo, Trump incarcerandam esse.)

Addendum 2025-Dec-15: Historian Heather Cox Richardson Explains it All

I try to listen to American historian Heather Cox Richardson on an regular basis. Her Letters from an American is worth checking frequently. I also like her YouTube videos, if only to hear her calm voice, explaining the horribly fascist reality of American politics at the moment.

This video is an excellent example, showing how relatively lower income inequality in the mid-20th century was a departure from the norm: the oligarchs think it is normal that they should rule. She relates the variety of ways the “reactionary right” has tried to reassert economic and political power, to undo the 20th century reforms and re-institute their will as law. It’s all there: the racism, the xenophobia/deportation fever, the moral panic over LGBTQ folk, the regressive tax cuts piling wealth into the top 1%, and so on.

Very worth 15 minutes of your time!

Notes & References

1: C Goldin & R Margo, “The Great Compression: The Wage Structure in the United States at Mid-century”, Qrtly Jnl Econ 107:1, 1992-Feb-01, pp. 1-34. DOI: 10.2307/2118322.

NB: To avoid a regrettable paywall, the link above is to a working paper version, NBER Working Paper #3817. ↩

2: JG Williamson & P Lindert, “Unequal gains: American growth and inequality since 1700”, Centre for Economic Policy Research VoxEU column, 2016-Jun-16. ↩

3: R Reich, “How Can Outrageous CEO Pay be Stopped?”, Robert Reich Substack, 2025-Dec-09. ↩

4: W Scheidel & SJ Friesen, “The Size of the Economy and the Distribution of Income in the Roman Empire”, Jnl Roman Studies 99, 2009-Nov. DOI: 10.3815/007543509789745223. ↩

5: Wikipedia Editors, “Silver Thursday”,Wikipedia, downloaded 2025-Dec-05. ↩

6: “Tom”, “Sam Altman’s Dirty DRAM Deal, Or: How the AI Bubble, Panic, and Unpreparedness Stole Christmas”, Moore’s Law is Dead blog, 2025-Nov-24. ↩

Gestae Commentaria

Comments for this post are closed pending repair of the comment system, but the Email/Twitter/Mastodon icons at page-top always work.